Strategies for analyzing the performance of your intellectual property portfolio (IP Performance)

One of the keys to having a good IP strategy is to correctly measure the behavior of your intellectual and industrial property portfolios. Depending on their performance, you can make decisions on the assets within them in the fastest and most effective way.

Furthermore, from a corporate point of view, for senior executives to fully appreciate the IP management work being done within their companies they need metrics that are strategically aligned with their company's objectives and that are related to their business knowledge. Let’s take a closer look.

How to correctly analyze IP portfolio performance in your company

Companies’ R&D or design departments generate a series of products related to innovation or brand identity. These projects must then be handed over to intellectual property specialists who decide how to handle them in terms of rights, patents, trade secrets and so on. Similarly, universities file patents to promote the success of their research and students, which has a direct impact on their reputation. Those patents are put on the market in the form of user licenses, since the schools don't directly manufacture or market products.

The key metrics for analyzing the performance of these types of portfolios are contained in a number of KPIs. Today, all the old IP metrics are still used (number of inventions filed versus disclosed, number of ideas generated in a certain period or attributed to each person on the team, number of innovations that have at least one patent granted or number of priority applications versus total number of disclosed inventions, and so on), although they are no longer static figures and are now tied to the company's business objectives. Making good use of these data is no trivial matter.

IP's contribution to profits and revenue: with product life cycles getting shorter and shorter, IP protection helps keep margins from eroding. Turnover and profit figures deriving from IP-protected products and services have become a metric to be taken into account, as has the percentage of turnover and profit associated with licenses.

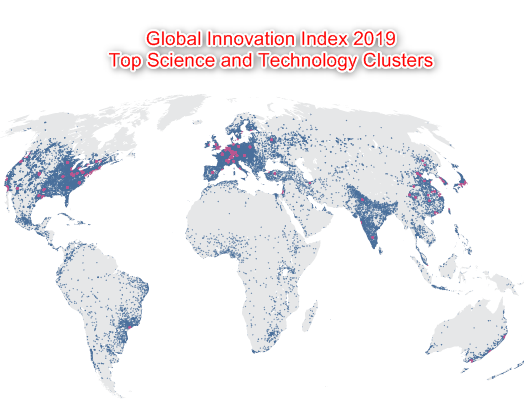

Intellectual property portfolio and asset value: setting the value of a patent is quite an art. Fortunately, the days are long gone when IP was considered a cost and not an asset. We already mentioned, in a recent post on the subject, that research indicates that approximately 70-80 percent of corporations' market capitalization is in the form of patents, registered trademarks, copyright and other intangible assets, and the value of IP portfolios is essential for analysts and investors.

IP strength and quality: Given the costs of filing and maintaining IP assets, the strength and quality of the innovation are decisive when prioritizing one innovation over another. Business pertinence and the strength of the technology help determine financial value.

IP organization and productivity: this category analyzes the size of the internal IP department, partners, and even the efficiency of certain parts of the portfolio. Analyses of the costs of legal proceedings and of productivity are particularly complex, as in some cases very specific knowledge is required on the part of the staff involved. However, having a global and in-depth view of these KPIs can provide answers to many of the questions and help to make better-informed decisions.

What KPIs should be taken into account for portfolio performance analysis

Analyzing a single aspect of intellectual property management is no easy task because of how these aspects interrelate with one another. Performance indicators are essential, but what other indicators should we consider? These are the most determinative:

- Portfolio maintenance and associated costs. Such as the price of renewal and defense, which are the most significant. Renewal costs and annual fees by branch, technology, or jurisdiction are also important.

- Market coverage. The set of IP-related rights, together with trademark use or disuse, has to be analyzed for each jurisdiction.

- Portfolio growth. Concessions or applications can be measured by groups (activity, type, jurisdiction, market, etc.). The key is to compare the number of concessions granted in a given period with the number of applications filed.

- Life cycle analysis: understanding the time that has gone by between granting or registering and when the IP right expires or is abandoned can allow you to eliminate or reduce any parts of the process that are inefficient.

In short, to have a solid IP strategy, it is essential to analyze the performance of intellectual property portfolios over a given period and to know how to draw the right conclusions. If you don't have professionals specialized in that area, SHIP Global IP, as a comprehensive IP services provider, can help you analyze your IP portfolio's performance.