_20240307090339.jpg)

The Value of IP to Attract Financing and Investment for Business Projects

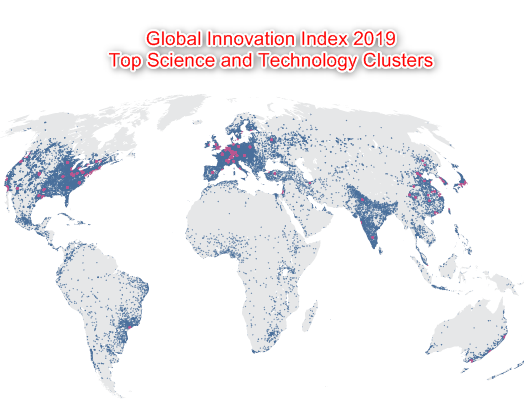

In today’s business world, intellectual property (IP) rights drive investments into business ventures to a larger degree than ever before. Recent estimates by patent valuation experts seen by SHIP Global IP indicate that IP rights and other intangible assets represent 90% of the value of companies listing their stock publicly on the S&P 500. According to the World Intellectual Property Organization, this value percentage has inverted since 1973, when intangible assets only represented 17 percent of the S&P 500’s corporate value.

If IP rights are important to the world’s largest companies, they’re absolutely critical to the small- and medium-sized enterprises (SMEs) looking to bring their innovative ideas to markets. Last October, a joint study conducted by European IP offices revealed that startups owning patent or trademark rights were 10 times more successful in securing seed stage funding than other startups that hadn’t obtained IP rights. Though patents and trademarks protect different types of intangible assets, the study concludes that both types of IP rights are key legal protections for cultivating a successful business environment that improves company profits.

Still, a majority of small businesses have not taken the steps they need to prepare legal filings that reap investment value from intangible assets. The joint study, conducted by the European Patent Office in partnership with the European Union Intellectual Property Office, also found that less than one-third of all European startups had filed applications to secure IP rights. Although nearly half of biotechnology startups are obtaining IP rights, competitive innovators in many other sectors are risking valuable market share by avoiding the necessary steps to IP protection.

Why Do Investors Like IP Rights?

Having a good business pitch is key to success. Too often, companies operating in the modern economy are talking about their competitive advantage without truly understanding their value proposition. In important moments, the ability to protect market share is often the deciding factor that makes or breaks a business decision.

There are several reasons why angel investors and venture capitalists alike want to see IP protections before making a financial decision:

- Credibility: Patent and trademark protections are a strong signal to both competitors and potential partners that a successful business strategy is being implemented.

- Uniqueness: Legal proof of an invention’s novelty and nonobviousness tells the entire world that you are one of a kind.

- Value: IP fluctuates in value more rapidly than physical properties, and often that value trends upward as licensing deals allow innovative products to reach more consumers.

- Exclusivity: IP protections provide confidence that a particular business has cornered a share of the market that competitors cannot enter without the patent owner’s permission.

- Exit Strategy: Should the best laid business plans fail, the sale of IP rights to operating companies can cover important expenses during dissolution.

Intellectual property is property, but its intangible nature allows it to be more quickly leveraged in the marketplace than physical goods that have to be manually transported. It is little surprise that IP has become more important to corporate value during the Internet Age, when global knowledge and information sharing has increased by many orders of magnitude. These are just a few of the many reasons why companies are quick to print “Patent Pending” or fix a trademark symbol on an innovative new product.

How to Prepare Your IP Portfolio for Successful Business Partnerships

It’s crucial for any entrepreneurial enterprise to spend time assessing their startup’s IP situation before revealing their innovative advantage during negotiations. Every year, many lawsuits are filed by patent owners against infringers that at one point presented themselves as potential business partners.

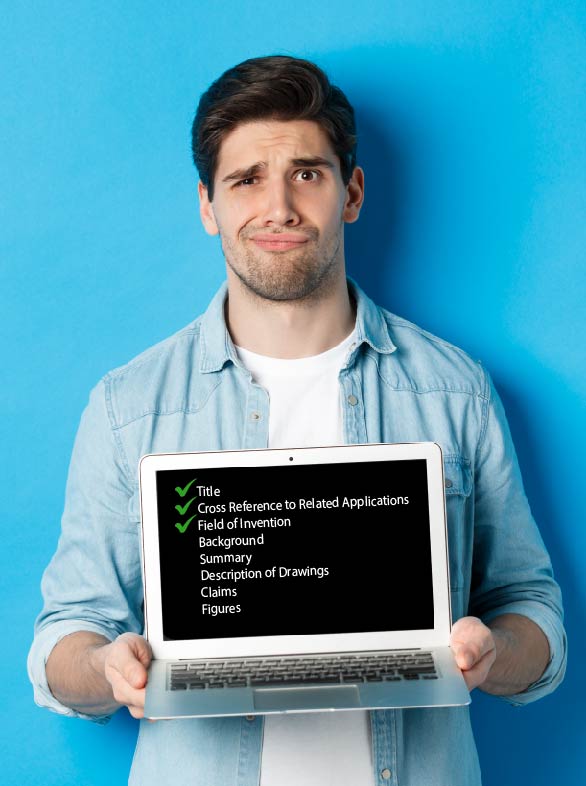

There are several steps that a startup should take to assess its IP situation in the current moment:

- Document: Keeping notes of an invention or standard images of a corporate logo will aid the IP application process.

- Audits: Conducting an assessment of your IP assets and needs at regular intervals ensures that your corporation reaps value while avoiding risks.

- Attorney: From patent prosecution to cease-and-desist letters, the services of a legal professional will be required to execute IP strategies.

SHIP Global IP works with many companies to protect important interests overseas by providing our unique technological solution that streamlines the intellectual property process, allowing our clients to work faster, enhancing their experience and giving them access at any time, from anywhere in the world, to all information relating to their intellectual property portfolio. We excel at ensuring that your patent filings are not only legally compliant but also highly accurate in languages used across the globe’s most important patent filing jurisdictions.