Innovation and Infringement Trends in the Telecom Industry: Generative AI, SEP Lawsuits and NPE Patent Monetization

The telecommunications sector has seen some of the greatest technological advances of any global industry over the previous two decades. Especially in the mobile networking space, where cellular networks have given way to several new forms of wireless communications like 5G and Bluetooth, implementing inventive new technologies is key to maintaining a strong consumer base. Here at SHIP Global IP, the decades of patent industry experience held by our professional staff gives us the perspective to see that while one particular emerging technology is set to transform the industry, a few sources of increased patent infringement litigation could create choppier waters for businesses to navigate.

Standard Essential Patents to Drive Infringement Suits Higher in Telecom Sector

The global telecommunications industry is reliant upon technological standards for wireless and cellular communications. The development of wireless and cellular networking standards by organizations like IEEE and ETSI make it possible for original equipment manufacturers (OEMs) to build components interoperable with those communication networks. In return for declaring patents as essential to a telecommunication standard, those patent owners are usually subject to obligations requiring them to license those standard-essential patents (SEPs) on a fair, reasonable and non-discriminatory (FRAND) basis.

Recently, SEP owners have decided to open global litigation campaigns rather than wait for arm's-length negotiations to result in licensing agreements. In mid-August, Japanese electronics conglomerate Panasonic filed lawsuits in several jurisdictions against Chinese smartphone companies Oppo and Xiaomi over SEPs implemented by the 4G networking standard developed by ITU. Device manufacturers implementing telecommunication standards without paying SEP royalties are finding themselves on the wrong side of massive verdicts. This March, London’s High Court ordered Chinese PC manufacturer Lenovo Group to pay nearly $140 million for infringing 3G, 4G and 5G SEPs owned by InterDigital.

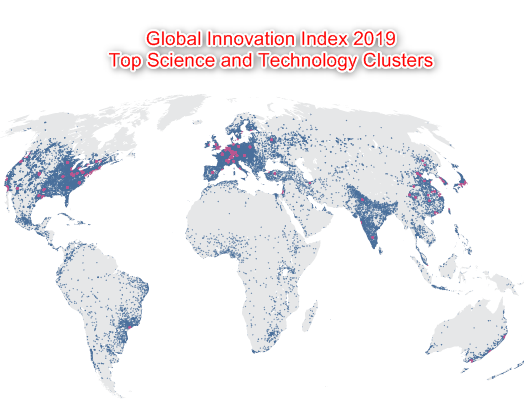

A rise in SEP lawsuits against standards implementing device manufacturers could reshape the global landscape for litigation campaigns across the telecommunications sector. Some court systems, especially UK courts, have been positioning themselves as leading jurisdictions for SEP lawsuit filings as those courts are shaping damages awards and injunctive relief based on global royalty rates paid to SEP owners. Other courts, like those in China, have been crafting equitable remedies known as anti-suit injunctions, which penalize parties who pursue related litigation in other court systems. These competing interests will make it more difficult to coordinate global litigation campaigns for SEP infringement in the future.

Generative AI Tech to Transform Language Processing in Telecommunications

Artificial intelligence (AI) is currently transforming many industry sectors as natural language processing and machine learning technologies have reached an inflection point. Today, a small amount of human textual input can produce annotated writings, original images or even computer code, all of which can have practical business applications. Consulting company McKinsey & Co. has recently identified a number of emerging technologies impacting the telecom sector, including applied AI and generative AI.

Applied AI systems, many of which are designed to improve productivity by automating backend activities for businesses, are helping telecom companies improve cost efficiencies in their information technology (IT) systems. This March, computing services giant IBM announced that it had entered into a partnership with Telecom Egypt to automate various network and IT monitoring activities, reducing the time spent by IT staff on some manual processes by as much as 18 hours.

Generative AI systems are having a watershed moment in 2023, and the telecom industry is only beginning to scratch the surface of how those technologies can improve global communications. In mid-August, South Korean company SK Telecom announced a $100 million investment into Anthropic, a startup developing a multilingual large language model generative AI system for improved communication across language barriers. Other generative AI applications in the telecom sector include more responsive call center systems for customer relationship management.

Recent Patent Portfolio Sales to Increase NPE Litigation Against Telecom Companies

Over the past two decades, companies operating in the telecommunications sector have faced a large amount of infringement lawsuits from companies that own patents but do not offer a good or service implementing the patented technology. Known as non-practicing entities (NPEs), these companies are often seen as adding an innovation tax to industries like telecom where those patent rights can be monetized or asserted.

Past waves of NPE activity have typically found their origins in the sale of major patent portfolios with patent assets claiming technologies in such broad terms that they can be asserted against most industry players. For example, in 2011, 6,000 patents previously held by Canadian telecom company Nortel were sold to Rockstar Consortium, an Apple- and Microsoft-backed NPE responsible for monetizing those patent assets against cellular networking companies operating on the 3G Long Term Evolution (LTE) standard.

While the post-bankruptcy sale of Nortel’s patent portfolio spurred a bidding war that is atypical of the industry, recent IP sales by leading R&D companies in the telecommunications space could bring a renewed threat of NPE litigation. This March, BlackBerry Limited, another Canadian telecommunications developer well past its corporate zenith, announced that it was selling substantially all of its non-core patent assets to a subsidiary of patent monetization company Key Patent Innovations Limited for a total of $900 million in cash and future royalties. Patent asset sales in the telecom sector are also being driven by Chinese telecom company ZTE. In recent interviews, this company has acknowledged that it will sell SEPs and other patent assets in order to “right-size” its portfolio to focus its licensing activities.

Telecommunication companies across the globe should stay well prepared by developing corporate strategies that can respond to the growing threat of patent litigation, both in the SEP space and from NPE patent owners. Still, the advent of AI technologies offer great promise to telecom firms who can leverage those developments to improve communications services for consumers across the globe.